A new report from NFT data company NonFungible.com estimated that sales of non-fungible tokens – or NFTs – hit US$17 billion in 2021.

That’s almost equal to the annual GDP of Botswana last year.

It also marked a massive jump from 2020, which logged US$82 million in sales.

The study, done in conjunction with L’Atelier BNP Paribas and Ubisoft, found over two million crypto wallets bought over 27 million NFTs

The report also suggested people are getting better at NFTs; investors generated a total of US$5.4 billion in profits from sales of NFTs, and that the average price for an NFT in 2021 was US$807, compared to US$49 in 2020.

NFTs broke into the mainstream last year following digital artist Beeple’s collage selling for a record US$69 million at a Christie’s auction, while popular collections like the Bored Ape Yacht Club have lured in celebrity buyers by the drove.

Blockchain data platform Chainalysis (which themselves estimated the NFT market hit US$41 billion last year) also noted there was a noticeable spike in the last week of August 2021, likely driven by a new release from BAYC.

They also observed that investors have flocked to NFTs in part because they believe they can achieve a high return on investments by purchasing them.

Ethan McMahon is an Economist with Chainalysis and told TechStorm: “Digital artwork is more easily bought and traded, making the distinction interesting. To trade or transfer an NFT, you don’t need to set up shipping, insurance or endure long wait times. The blockchain makes this instantaneous and more accessible to a wider audience.”

He also had this advice for first-timers looking to purchase their own NFTs – watch out for fakes and scams.

“Some bad actors may create collections that look like or are named similarly to more well-known pieces of art. Their goal is to trick people into thinking what they’ve created is more valuable than it may actually be. Buyers can mitigate this risk by researching the artist before buying and making sure the collection is the one they’re actually interested in,” said McMahon.

And for scams, he suggested one be active on social media “to be aware of which collections are coming to market or are popular. Unfortunately, by doing so, you are at risk of receiving inbounds from people looking to deceive you and coerce you into buying their projects. It’s not necessarily a rug pull, it could just be a person asking for you to click on an innocuous looking link that will drain all your funds from a wallet.”

So if you’re looking to join the NFT rush – be aware and be informed!

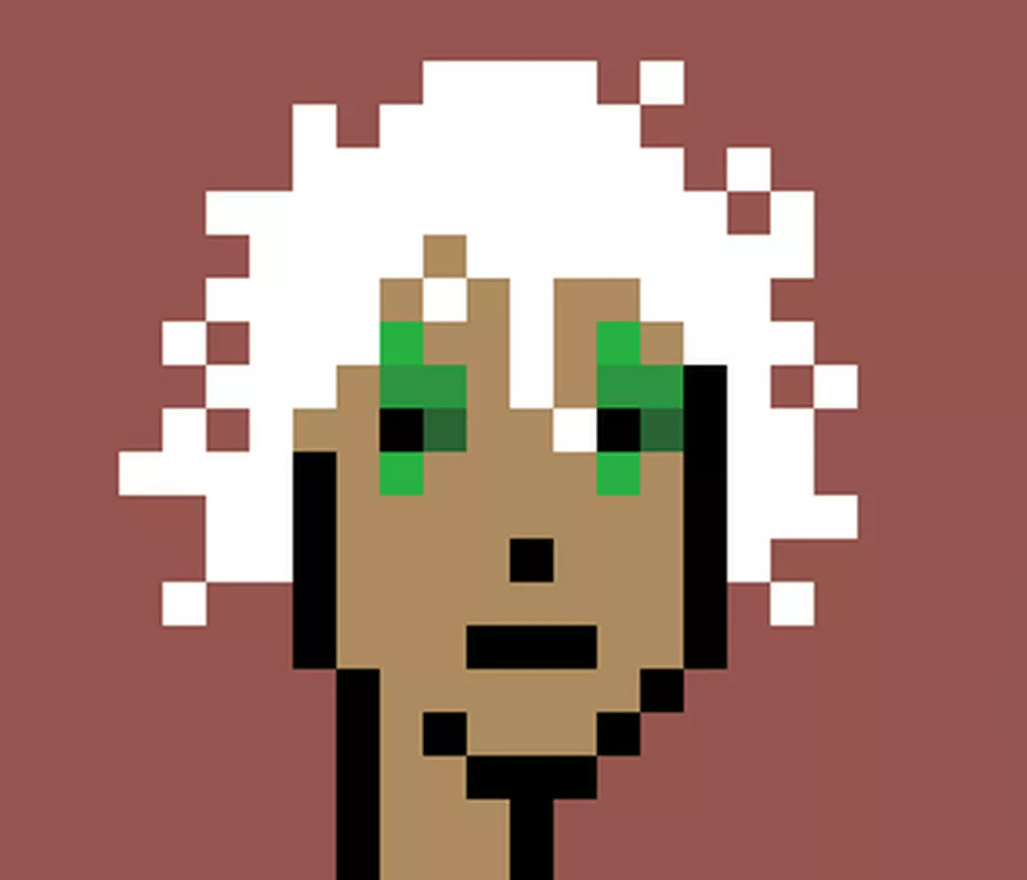

*Featured image from CryptoPunk #9998

By Samantha Chan \ 11:00, 16 March 2022